Gold continues its upward trend – Barranco Gold Mining Corp. in the current market environment

A comprehensive debt package is currently being put together in the US. With the so-called "One Big Beautiful Bill," the government is raising the debt ceiling by around five trillion US dollars. The effects are already becoming apparent: the US dollar is losing strength, confidence in the currency is declining, while the price of gold is reaching new highs. The USD 3,600 mark has now been exceeded, and many market observers continue to view the overall upward trend as intact. Inflation, growing budget deficits, and geopolitical uncertainties are once again bringing gold into sharper focus on the markets.

Barranco Gold Mining Corp. is a junior exploration company with projects in politically stable regions. Rising gold prices can have a fundamental impact on exploration stocks, particularly companies with a clearly defined work program and corresponding financing structure. Barranco Gold Mining is focused on further developing its project areas and regularly publishes information on progress from ongoing exploration.

The global political situation remains tense. Conflicts in the Middle East, the war in Ukraine, and ongoing trade disputes are contributing to increased uncertainty on the financial markets. In such phases, gold is becoming increasingly attractive as an asset class. Market phases of rising commodity prices often lead to early-stage exploration projects being monitored more closely. Regardless of this, early-stage exploration companies differ significantly in their risk profile from a direct investment in physical gold.

Since its initial listing at €0.80, Barranco Gold Mining's share price has moved significantly. The company remains in an early stage of development, with operational progress and published exploration data playing a key role in its further development.

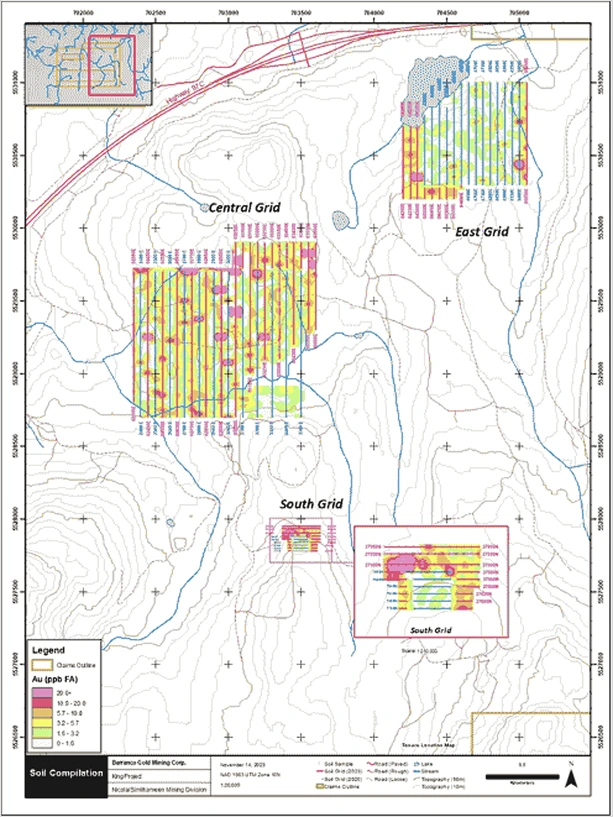

Barranco Gold Mining recently reported new results from its 100% owned King Project in British Columbia. As part of a systematic soil sampling program, a total of 726 samples were analyzed across three grid areas (Main, South, East). The evaluations show geochemical anomalies that are spatially related to regional fault zones and intrusion contacts. The data obtained will serve as the basis for further exploration planning in the project area.

Click on the button to open WhatsApp.

You thereby accept our data protection information.

Important information pursuant to Section 85 WpHG, Section 86 (1) WpHG, Art. 20 MAR and Delegated Regulation (EU) 2016/958

1. details of the author and publisher

This financial analysis was prepared by Mr. Achim Mehler in his capacity as analyst pursuant to Section 85 (1) sentence 1 WpHG and responsible editor. The publisher is Zantino GmbH, Ernst-Barlach-Str. 20, 36041 Fulda (Managing Director: Mr. Mehler, info@zantino.de).

2. status of this publication

This publication is an "investment recommendation" within the meaning of Art. 3 para. 1 no. 35 MAR. It has not been prepared in accordance with the legal requirements to promote the independence of investment research (MiFID II Delegated Directive 2017/593) and is therefore to be regarded as marketing communication.

3. no investment or tax advice

The content is for information purposes only. It does not constitute individual investment or tax advice or an offer or solicitation to buy/sell financial instruments. Zantino GmbH assumes no liability for the accuracy, completeness or timeliness of the information and is not liable for any damages resulting from its use, except in cases of willful misconduct or gross negligence.

4. information and data sources

Only publicly available information was used, e.g:

- Ad hoc announcements

- Annual reports

- Industry studies

- Press releases

- Data originating from the company

The sources are checked for plausibility by the author to the best of his knowledge.

5. valuation methods

The assessment is based, among other things, on:

- Fundamental analysis (e.g. DCF, P/E comparison)

- Growth and potential analysis ("blue sky scenario")

- Technical analysis (chart technique)

- Market-psychological momentum approaches for stocks close to the market

6. risks and forward-looking statements

Forecasts, price targets and other forward-looking statements are based on assumptions and estimates. They are no guarantee for future developments and may change due to unforeseeable events. In the case of highly volatile small caps, there is an additional risk of significant price fluctuations and even total loss of the capital invested.

7 Conflicts of interest

The creator/publisher and/or persons associated with them:

- currently hold positions in the shares discussed and can trade them at any time;

A complete list of all relevant conflicts of interest within the meaning of Art. 6 DelVO (EU) 2016/958 is available free of charge on request.

8. organizational measures (compliance)

Zantino GmbH has internal guidelines for the avoidance and disclosure of conflicts of interest. Due to the size of the company, responsibility for compliance with these guidelines lies directly with the Managing Director. There is no prior review by an independent compliance officer.

9. update policy

There is no obligation to update the analysis or the price targets contained therein. Changes may be made without prior notice if market or company events make this necessary.

10. restrictions on distribution and use

This publication is intended exclusively for professional investors (MiFID II) or comparable counterparties and may not be directly or indirectly transmitted or distributed in the USA, Canada, Australia or Japan. Not intended for distribution to retail clients.

11 Competent supervisory authority

Federal Financial Supervisory Authority (BaFin) Marie-Curie-Str. 24-28, 60439 Frankfurt am Main, Germany.

12. copyright

© 2025 Zantino GmbH. All rights reserved. Reproduction or distribution - even in part - requires written permission.

By accepting this publication, you accept the above restrictions as binding on you. Additional information about the content of this publication is available on request.